MAF allows investors to participate in the Asian century with confidence while protecting against market crashes.

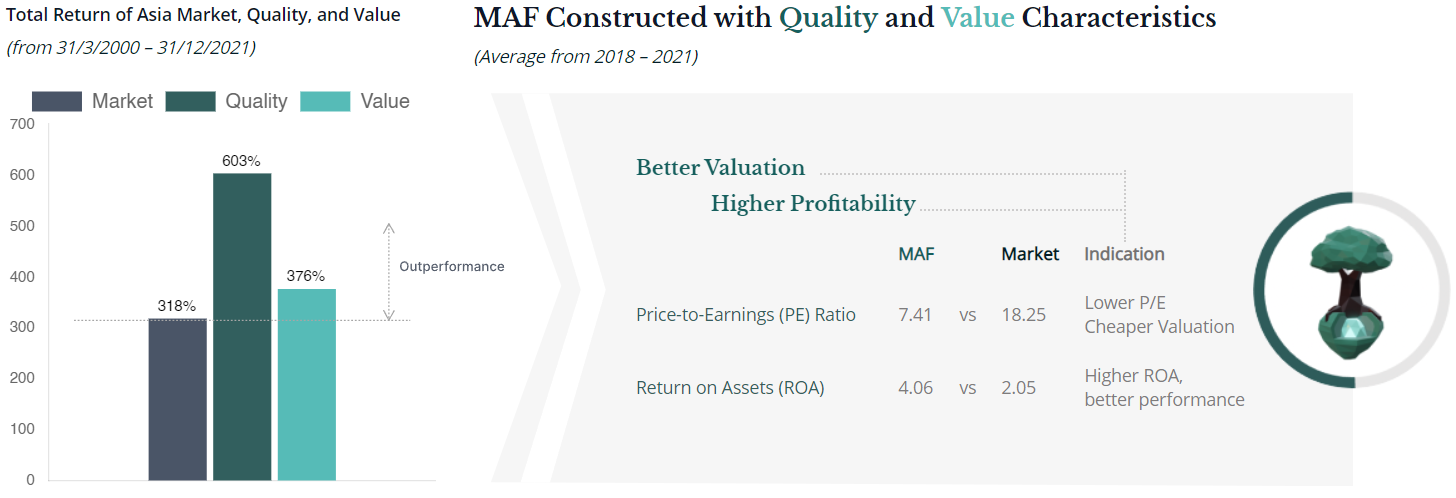

How do we know which companies have the potential to do well? Some investors base their decisions on a story or newspaper headlines. We prefer to be guided by facts rather than stories. Systematic analysis helps us to screen through the entire universe and find the hidden jewels. MAF investors get a portfolio with better profitability at a better valuation than index investors, allowing them to participate before the market recognises these opportunities.

(from 31/3/2000 – 31/12/2021)

| MAF | Market | Indication | ||

|---|---|---|---|---|

| Price-to-Earnings (PE) Ratio | 7.41 | vs | 18.25 | Lower P/E Cheaper Valuation |

| Return on Assets (ROA) | 4.06 | vs | 2.05 | Higher ROA, better performance |

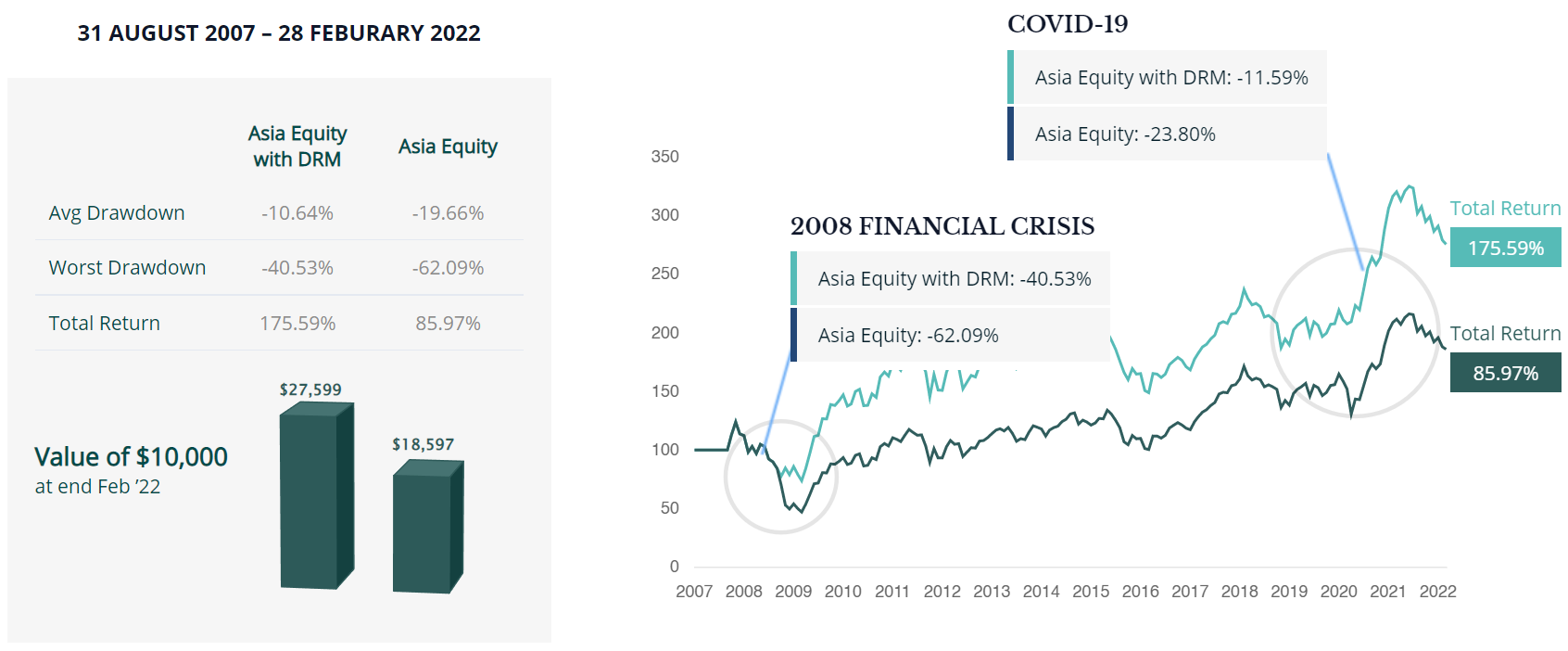

Markets take turns performing; investors need to have patience and plenty of confidence while investing in Asia. Even though we are already in the Asian Century, as Ray Dalio described in his book, the journey will not be smooth.

MAF is designed to allow one to enjoy Asia equity market return with confidence by avoiding:

1. Financial pain: Large losses lead to negative compounding. If you invested in Asia Ex Japan just before the 2008 GFC, you would have achieved an 86% total return (the worst can happen to anyone). With MAF, however, your return would be improved to 175%.

2. Psychological pain: The worst is not getting in just before a market crash; the worst is when investors cannot take the pain, invariably liquidating their investment, resulting in permanent capital loss.

| Asia Equity with DRM |

Asia Equity | |

|---|---|---|

| Avg Drawdown | -10.64% | -19.66% |

| Worst Drawdown | -40.53% | -62.09% |

| Total Return | 175.59% | 85.97% |