The near-zero interest rates of the past decade have posed a significant challenge in generating income from fixed income investments, which have traditionally been favored for passive earnings. However, as interest rates climb rapidly from near-zero levels , fixed income and alternative investments are now offering investors with attractive returns and a renewed opportunity to generate a solid stream of income.

Source: Bloomberg, Finexis Asset Management. Average 10 years’ yield data from 31/1/2013 – 30/12/2022. Today’s yield as at 31/8/2023. US Investment Grade: Bloomberg US Agg Yield. Asset Backed Security (ABS): Bloomberg US Corporate Yield. US High Yield: Bloomberg US Corporate HY Yield. Senior Loans: Credit Suisse Leveraged Loan Yield. EM High Yield: Bloomberg Emerging Markets HY Yield. Asia High Yield: Bloomberg Asia HY Yield. Alternative: Swiss Re Cat Bond Yield.

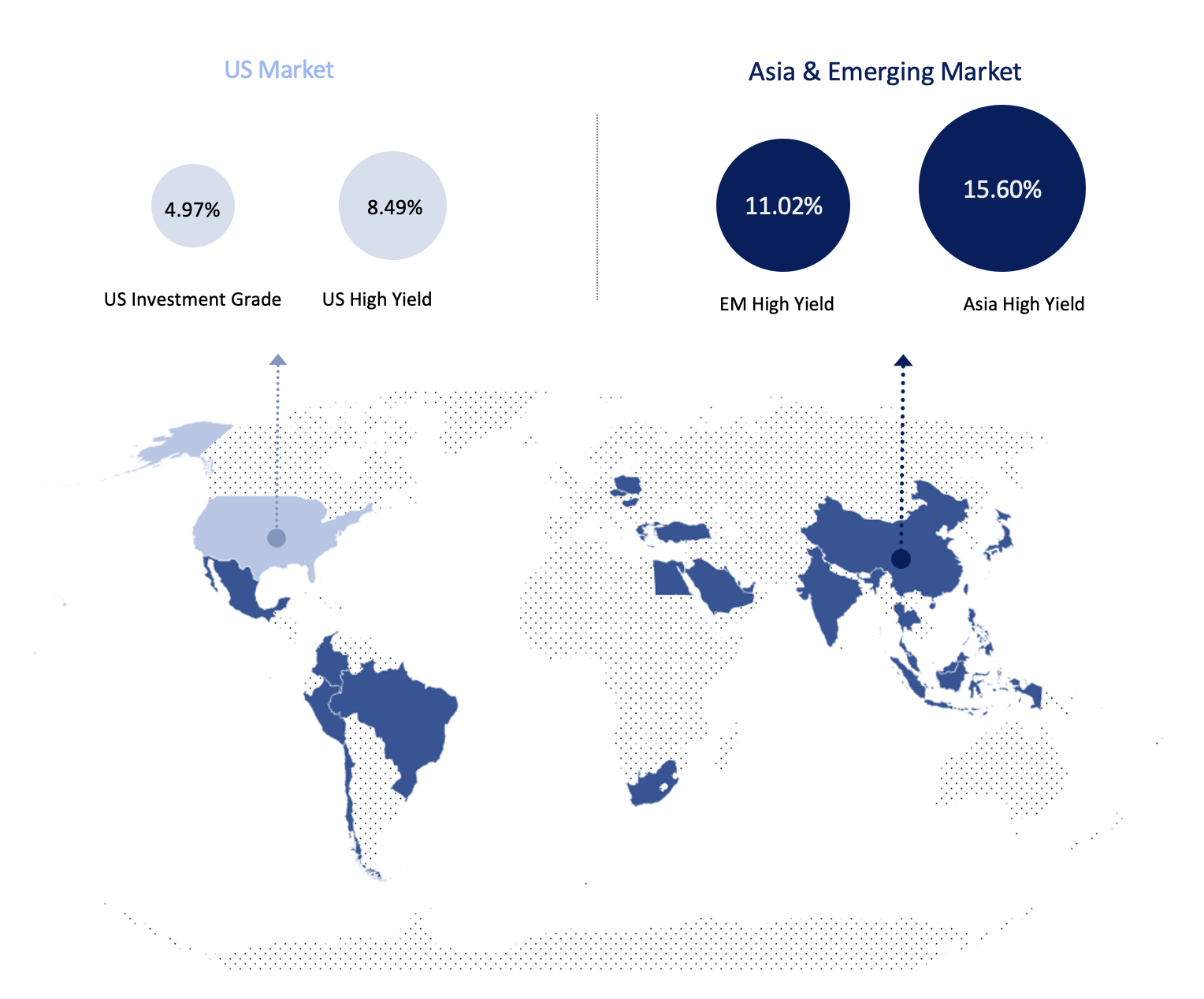

Better income opportunities exist beyond developed markets in lesser-explored segments, such as Asia and Emerging Markets, that offer higher income and are less commonly found in existing income strategies . At the same time, non-market-related income sources such as Alternatives complements and reduce the underlying asset price movement while still maintaining a truly diversified income potential.

Source: Bloomberg, Finexis Asset Management. Yield quoted as at 31/8/2023.US Investment Grade: Bloomberg US Agg Yield. US High Yield: Bloomberg US Corporate HY Yield. EM High Yield: Bloomberg Emerging Markets HY Yield. Asia High Yield: Bloomberg Asia HY Yield.

The strategy aims to generate multiple streams of truly diversified and solid income with the potential for capital appreciation to fulfill investors’ income needs.